Proper venturing into the dynamic earth of trading, understanding possible tools and techniques may make the big difference between minor results and fantastic success. A particularly revolutionary way traders are augmenting their opportunities is through cfd trading. Agreements for Huge difference (CFDs) are gaining interest world wide as they give traders substantial control to increase their market potential.

This article dives in to the concept of CFD trading, how it works, and most of all, the advantages of leveraging in this trading method. Whether you are skilled or just exploring the world of trading, that manual presents insights in to why CFD trading could possibly be price exploring.

An Overview of CFD Trading

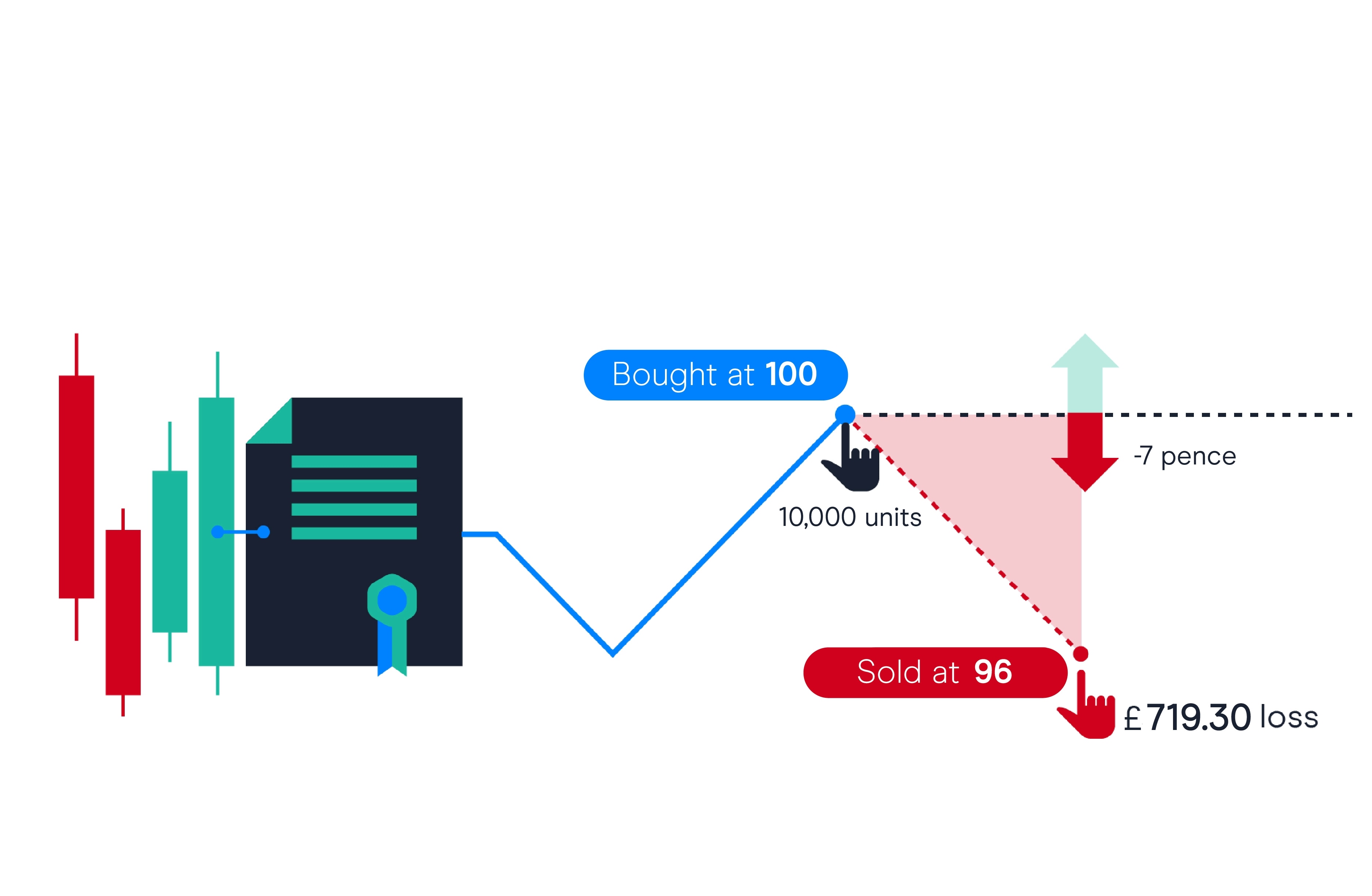

CFDs are financial derivatives that enable traders to suppose on the price action of a wide range of economic instruments, including shares, indices, commodities, currencies, and even cryptocurrencies, without possessing the underlying asset. Instead, traders enter into an agreement with a broker to change the huge difference in value from enough time a trade is opened to when it's closed.

That innovative design permits traders to make money from both upward and downhill value movements. If the price tag on a property rises and you believed upward movement, you get the cost big difference at the close of the trade. Conversely, in the event that you effectively forecast a shed, you revenue even as the asset's price declines.

CFDs signify an important element of contemporary trading giving people usage of worldwide markets and value action speculation. But the real game-changer lies in the influence it offers.

What is Power in CFD Trading?

Power may be the economic process that enables traders to gain larger contact with the markets using smaller levels of capital. It's like borrowing income to increase your potential gain (or loss) without doing the whole value upfront. If employed effectively, influence can be an amazingly powerful tool in CFD trading.

For example, guess a trader wants to purchase the stock market, and one share costs $500. With control, in place of investing the whole $500, they might only require $50 to open the exact same trade. This gives traders access to opportunities and markets they could have otherwise considered out of reach.

Leveraging primarily multiplies the potency of your capital, helping you receive more out of each and every dollar invested.

Knowledge the Advantages of CFD Trading With Leverage

CFD trading's design and functions bring numerous advantages for traders trying to optimize their industry interactions. Here's how leveraging in this trading approach can gain formidable traders:

Improved Industry Accessibility with Less Initial Money

One of the greatest issues for newer or smaller traders is having enough money to opportunity into diverse economic markets. Power solves this problem by decreasing the access barriers.

Despite having a modest investment, traders can start roles in global areas that will have usually been inaccessible. As an example, in markets wherever costly resources like large-cap stocks dominate, leverage makes it practical for smaller-scale traders to participate meaningfully.